county tax liens nj

In fact the rate of return on property tax liens investments in. Essex County Tax Board 495 Dr.

Tax Collector Millburn Township Nj Official Website

Morris County NJ currently has 3258 tax liens available as of November 4.

. In fact the rate of return on property tax liens investments in Union. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Essex County NJ currently has 14955 tax liens available as of November 4.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. Union County NJ currently has 7375 tax liens available as of November 5.

Tax Rate Last Revaluation 2022. Find the best deals on the market in Atlantic County County NJ and buy a property up to 50 percent below market value. Tax Lien Certificates Sec.

In New Jersey county treasurers and tax collectors sell tax lien certificates to the winning bidder at the delinquent property tax sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Bergen County Board of Taxation Two Bergen County Plaza 1st Floor Hackensack NJ 07601-7076.

This website has been designed to provide property. A tax lien is filed against you with the Clerk of the New Jersey Superior Court. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

CODs are filed to secure tax debt and to protect the interests of all taxpayers. Martin Luther King Jr Blvd Room 230 Newark NJ 07102 Together we make Essex County work. A tax lien in New Jersey is a statutory lien that arises due to delinquent taxes.

Typically there are municipality taxes on properties lands water sewer charges and electricity. 5 Year Tax Rates 2003-2007 2008-2012 2013-2017 2014-2018 2015-2019 2016-2020 2017-2021 2018-2022. Investing in tax liens in Bergen County NJ is one of the least publicized but safest ways to make money in real estate.

All liens must be against Essex County residents or property. Salem County NJ currently has 1682 tax liens available as of November 5. In fact the rate of return on property tax liens investments in.

What you must do. Submit the official document in person or via mail to PO Box 690 Newark NJ 07101-0690. Investing in tax liens in Middlesex County NJ is one of the least publicized but safest ways to make money in real estate.

Monmouth County NJ currently has 8412 tax liens available as of November 5. Revaluation of a Community Brochure. Shop around and act fast on a new real estate investment in your.

Investing in tax liens in Union County NJ is one of the least publicized but safest ways to make money in real estate.

Cuyahoga County Sells Liens On Properties With Delinquent Taxes Cleveland Heights Oh Patch

New Jersey Tax Lien Auction Pre Sale Review Florence Nj Online Sale Youtube

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

Franklin Nj Seeks Reassessment Plan As Home Prices Sales Spiked

Nj Property Owner Search County Property Search New Jersey

Tax Collector S Office City Of Englewood Nj

New Jersey Sales Tax Small Business Guide Truic

Tax Finance Dept Sparta Township New Jersey

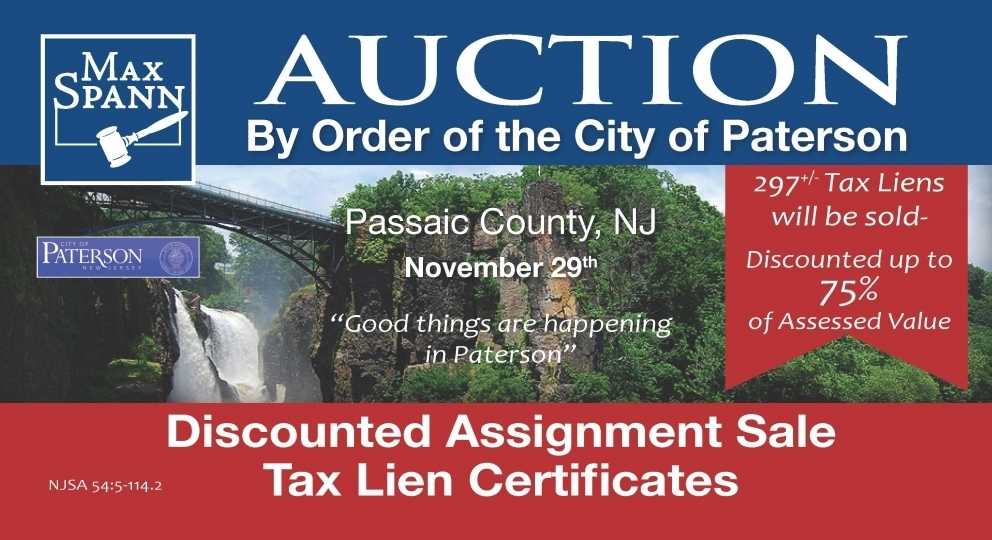

297 Tax Liens Will Be Sold Discounted Up To 75 Of Assessed Value In Paterson Nj

The Official Website Of The Township Of Belleville Nj Tax Collector

Sheriff S Sale Information Union County Sheriff S Office

New Jersey Real Estate Tax Foreclosure Attorneys

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

![]()

Tax Sales Tax Collectors Treasurers Association Of Nj

Office Of The State Tax Sale Ombudsman

How To File A New Jersey Construction Lien A Step By Step Guide

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation